The majority of banks require a minimum of 10 percent down; however, Bond suggests putting down a minimum of 20 percent to prevent paying personal home loan Learn more here insurance. Private mortgage insurance is default insurance coverage payable to a lender, and it can include a couple of hundred dollars to your monthly mortgage. Additionally, recurring payments such as home loans, credit card payments, vehicle loan, and child assistance, are utilized to identify your financial obligation to earnings ratio (DTI).

If you make $18,000 a month, your DTI would be 33 percent which falls within the range where a bank would lend. The risk of not having a credit report is one barrier that could halt or delay the application process. According to Miller, simply using a debit card can help you start to establish a credit history.

The loan provider evaluates your work history, task stability, and deposit when identifying whether you have the ability to repay. "If you've been on your wfg lawsuit first task for a month, you may wish to provide yourself a little time to build a cost savings prior to leaping right into a home mortgage," states Miller.

Do your research to find a mortgage officer that comprehends your family objectives and objectives; somebody who can be a resource throughout the entire home mortgage procedure - who took over taylor bean and whitaker mortgages. Consumer Affairs is an excellent location to begin; the publication offers http://beckettgeua257.timeforchangecounselling.com/a-biased-view-of-how-does-bank-know-you-have-mutiple-fha-mortgages countless evaluations for lots of different lending business. Identifying your debt-to-income ratio and understanding just how much of a monthly home loan payment you can afford will keep you from overextending yourself and becoming "house bad.".

Many or all of the products included here are from our partners who compensate us. This might influence which products we blog about and where and how the item appears on a page. Nevertheless, this does not affect our assessments (what are the lowest interest rates for mortgages). Our opinions are our own. You've decided to buy a home.

Not known Incorrect Statements About Which Banks Offer Buy To Let Mortgages

Take a huge breath it's not every day you get a loan with that numerous absolutely nos. Preparation is crucial, due to the fact that after your purchase offer is accepted, the clock is ticking. Closing a home loan deal takes about 45 days typically. "If you participate in the process without [the correct] information, it could slow you down," states Randy Hopper, a vice president at Navy Federal Cooperative Credit Union.

Now that you've made a deal on a home, it's time to choose the finalist that you will actually obtain the money from. Start by phoning loan providers (3, at minimum), visiting their offices or submitting their home loan applications online. Easiest of all: Ask an agent to complete the type while you provide info by phone or face to face, states Carlos Miramontez, vice president of home loan financing at Orange County's Credit Union in California.

Mark Burrage, USAA "If you want to start online, and you specify where you need more info or just desire to talk with a live human being, the large bulk of lending institutions are established to where you can carry switch," states Mark Burrage, an executive director for USAA.

And your credit report will not struggle with submitting several applications as long as you submit them all within a 45-day window. You must constantly submit several applications so you can compare offers later on. It's an excellent idea to employ a house inspector to evaluate the property's condition right away, even though loan providers do not need it.

This will cost around $300 to $500. The loan providers ask authorization to pull your credit. By law, a lender has 3 organization days after getting your application to offer you a Loan Price quote kind, an in-depth disclosure revealing the loan amount, type, interest rate and all costs of the home mortgage, consisting of hazard insurance, mortgage insurance coverage, closing costs and real estate tax.

The What Are Lenders Fees For Mortgages PDFs

Now utilize your Loan Estimate forms to compare terms and costs. At the upper right corner of the very first page you'll see expiration dates for the interest rate learn if it's "locked" and closing expenses. Ask the lender to discuss anything you do not comprehend. If the numbers seem excessive, "Don't focus too much on rate," Burrage states.

These will enable you to quickly compare deals: This is all charges consisting of interest, principal and home loan insurance coverage that you'll sustain within the home loan's very first five years. This is the amount of principal you'll have paid off in the first 5 years. Likewise referred to as its yearly portion rate. This is the portion of the loan paid in interest over the whole life of the mortgage.

The loan provider's job is to answer all your questions. If you can't get excellent answers, keep shopping. [Back to top] You've compared lenders' rates and costs. Now evaluate their responsiveness and trustworthiness. Reconsider anyone who makes you feel pressured, Burrage says. His advice: "Go with somebody you can rely on." Then get in touch with the lender of your choice to say you're all set to continue.

[Back to top] Every declaration you made on your mortgage application goes under the microscope in this stage. Brace for questions and file requests. Responding promptly keeps everything progressing. You stated you make $50,000 annually at Acme Software? The processor takes a look at your pay stubs and calls Acme's HR department to validate.

[Back to top] Your task now is to stand by. If you're needed at all, it will be to answer more concerns and produce more documents. The underwriter's job is to evaluate the threat of providing money to you on this residential or commercial property. What's your loan-to-value ratio? Do you have the capital to make the month-to-month payments? How about your "credit character"? What's your history of paying on time? Is the home valued properly, the condition excellent and title clear? Is it in a flood zone? [Back to top] In this final step, the lender must act before the borrower can move forward.

What Are The Current Refinance Rates For Mortgages for Dummies

It reveals the comprehensive and last expenses of your mortgage. Examine the Closing Disclosure thoroughly to compare it against the Loan Estimate type to see if any of the priced estimate fees or numbers have changed. If they have, ask the lender to discuss. Compare the Closing Disclosure with your Loan Quote to see if any of the priced estimate fees or numbers have altered.

[Back to top] This is the minute to decide if you want to proceed. If you do, you're on to your closing, with, yes, one last mountain of paperwork to sign. However it'll soon be over. You've finished the home loan application marathon and claimed your glossy new loan. Well done.

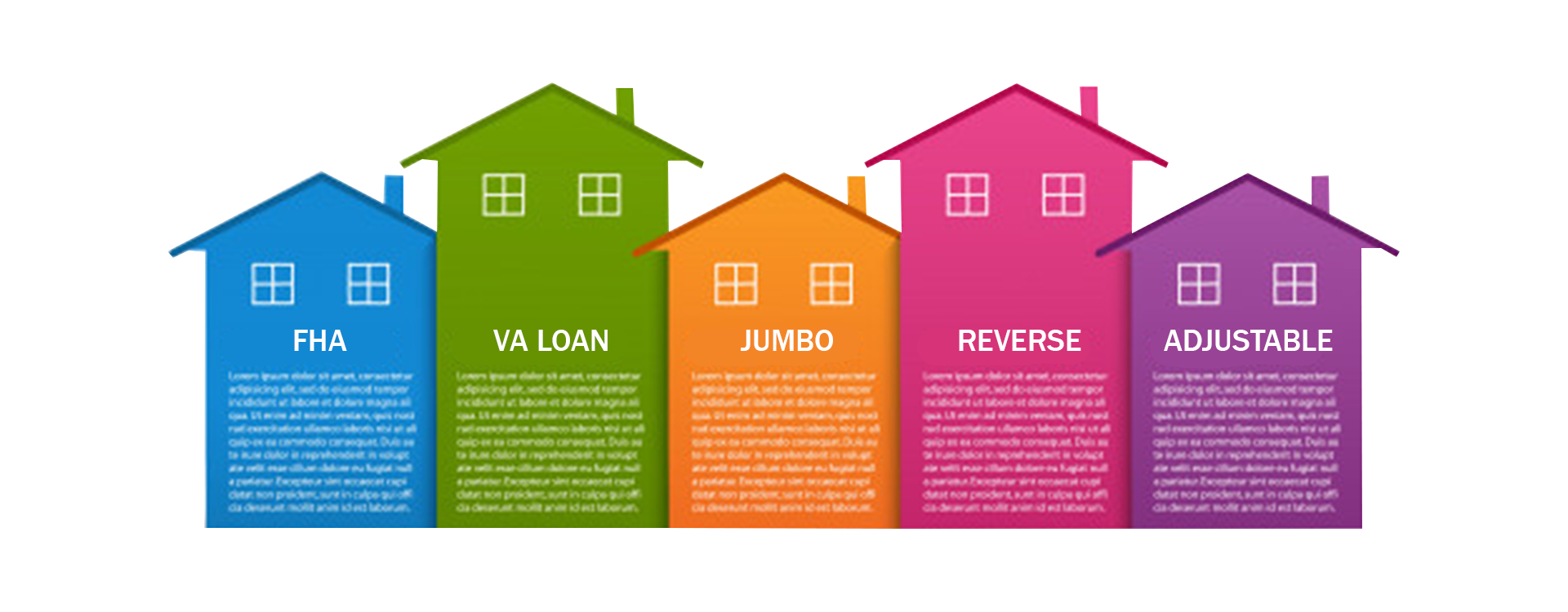

Fixed-rate or variable-rate mortgage? To escrow or not to escrow? Pre-qualification vs. pre-approval? Home mortgage funding can seem confusing, but it does not have to be. There are a couple of key things to comprehend, and the more you know, the more prepared you'll be. Type of loan that is protected by genuine estate (i.

Unless you are paying money for the house, you'll need a home mortgage. You guarantee to pay back the lender (usually in regular monthly payments) in exchange for the cash used to acquire the house. If you stop paying, you'll go into default, which indicates you have actually stopped working to satisfy the terms of the loan and the lender can take back the residential or commercial property (foreclosure).